Do you know what is Bank Financing? you might or might not know,

By the end of this article, you would be able to understand what is Bank Financing with its types and I also share with you Some advances granted by commercial banks.

Banks provide short term financing to industry, trade and commerce.

Banks are the main constituents of the money market.

What’s in it for you

- What is Bank Financing?

- What are the types of bank financing?

- Some advances granted by commercial banks.

- Example

- Conclusion

- FAQ

What is Bank Financing?

Bank financing is short and medium term finance.

The money market is a highly organized market where monetary transactions for short term financing are affected by the process of accepting deposits and lending money.

Bank financing helps to float surplus cash and it contributes to financing the working capital requirements of industry, trade, and commerce.

In fact, the Bank financing produces a large part of the working capital of a business.

Bank financing is related with floating cash and its utilization in industry, trade and commerce through banking system.

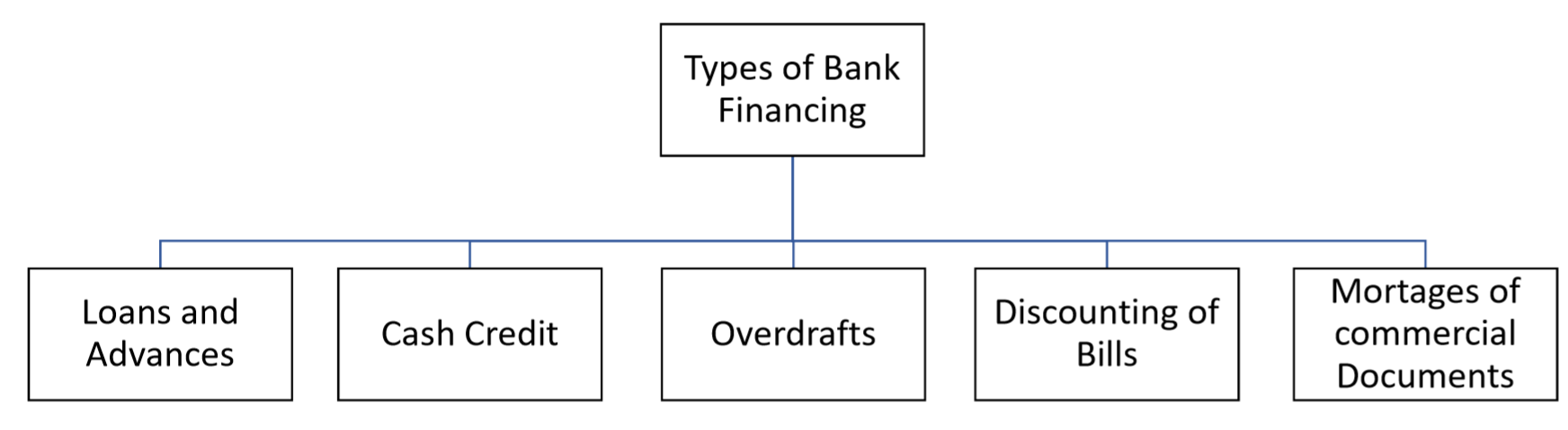

What are the types of bank financing?

The different methods of bank financing are:–

LOANS AND ADVANCES

Commercial banks provide lump sum amount of loans and advances as short term lending to businessman against the security of gold, silver, land and building, stocks and shares, movable properties, negotiable instruments like bills of exchange, fixed deposit receipts, life insurance policies, unit trust certificates, etc.

The bank asks for securities to the borrower if he applies for loans and advances.

The bank opens a loan account in favor of the borrower after they satisfies on the securities.

After that, the sanctioned amount of loan is shown in the current deposit account of the borrower.

consequently, the borrower withdraws the required amount from this account as and when needed either in full at a time or part by part.

In all cases, interest at fixed rate is charged on the full amount of loan from the date of sanctioning the loan irrespective of the amount of withdrawn.

A loan is repaid in the form of either through installments or at a time.

As the lump sum amount is provided as a loan, it fulfills the substantial financial requirements of the borrower. Commercial banks give advance against the collection of bills handed over to them. Sometimes, advances are also given against securities.

Commercial banks usually provide short term loans up to a period of 1 year for meeting the working capital requirements of business firms.

But term loans may also be provided for medium-term (which is repayable within 1 to 5 years) and long term (which is repayable after 5 years).

The commercial banks sanctioned a type of loan, viz. demand loan. A demand loan is a loan that is to be payable on demand.

There are two type of advances, viz.–

- Marginal advances where advances are given on the basis of margin rate.

- Clear advances where no condition is imposed in advance.

CASH CREDIT

Cash credit is another form of short term lending.

it is an agreement under which a borrower is allowed an advance up to a certain limit against the security of tangible assets or guarantees.

The borrower needs not to borrow the entire amount of advance at one time, rather he can draw as often as required provided the limit of cash credit does not exceed, it also known as secured credit.

But if the cash credit is provided without any security, we can call it clean cash credit.

The borrower gives a promissory note signed by two or more sureties in case of clean cash credit.

The interest is charged on the actual amount of cheque drawn and not on the whole amount of cash credit sanctioned.

This provides the working capital requirement of the traders.

In addition, the amount of credit deposited in the deposit account of the borrower and the borrower draws cheques to withdraw money therefrom.

moreover, you can again withdraw the amount which is repaid.

The borrower also enjoys the facility of repaying the amount, partially or fully, as and when he wants.

OVERDRAFTS

Under this agreement, the commercial banks allow its customer to overdraw their current account up to a certain limit that it shows a debit balance.

So, the opening of an overdraft account requires that a current account will have to be formally opened.

In addition, the account holder can mortgage shares, stocks, fixed deposit certificates, life insurance policy, unit trust certificates, gold and silver, etc.

You may need a guarantor for an overdraft.

certainly, bank charges Interest at a fixed rate on the excess amount withdrawn.

The amount of overdraft limit is not generally as high as loans and cash credit.

However, it is a very popular method of short term lending because it helps the borrower to tide over temporary financial difficulties.

The charges applied to customers are based on daily withdrawn but not on the limit sanctioned.

The main difference between bank overdraft and cash credit is that overdraft is allowed for a shorter period and it is a temporary arrangement whereas the cash credit is allowed for a longer period of time.

DISCOUNTING OF BILLS / PURCHASE OF BILLS

Bills of exchange arises out of trade transactions, the seller of goods draws the bill to the purchaser.

The bill may either clean or documentary i.e., supported by a document of title to goods like a railway receipt.

In addition, It may be payable on demand or after a period not exceeding 90 days.

most importantly, Commercial banks finance the business concern by discounting their bills at a price lower than their face value. The bankers, however, collect the full amount on the maturity date.

As a result, the difference between these two amounts represents the earnings of the bankers for the period. This item of income is called a ‘discount’. in case the Bills of exchange are dishonored by non-payments.

The bank recovers the full amount of the bill from the customer along with expenses incurred in that connection.

Sometimes approved customers purchase Bills of exchange.

Although the term ‘bills purchased‘ gives the impression that the bank becomes the owner of such bills, in actual practice the bank holds the bill only as a security for the advance.

A bank has to be very cautious and grant advances against the purchase or discount of a bill only to those customers who are creditworthy and have established a steady relationship with the bank.

In short, this is a popular form of short term credit. In this case, the borrower need not to furnish any security.

Commercial banks generally provide bill discounting facility to domestic traders and exchange banks to import and export traders.

MORTGAGE OF COMMERCIAL DOCUMENTS

Commercial banks also provide short term credit to borrowers against the mortgage of various commercial documents like bill of exchange or hundis, bills of lading, invoice, letter of credit, letter of intent, etc.

The commercial bank grants some other form of advances such as:

Advance Against Goods

The term goods include all forms of movables, such as agricultural commodities, industrial raw materials or partly furnished goods, etc.

In short, a banker accepts them as security and allows advances against them.

Advance Against Documents Of Title To Goods

Some of these documents include a bill of lading, dock warehouse keeper’s certificate, railway receipt, etc.

An advance against the deposit of such documents is equivalent to an advance against the deposit of products themselves.

Advance Against Supply Bills

The banks may grant an advance against bills for supply of goods to the government or semi-government departments and those are obtaining against an order after the acceptance of a tender.

Again, advances against bills from contractors for work executed either wholly or partially entered into with the government agencies also come under this category.

Example

You may need working capital for day to day cash transactions for your business.

Some major financial institution or Banks which provide Bank financing such as,

- Industrial Finance Corporation of India (IFCI)

- State financial corporation (SFCs)

- Industrial credit and investment corporation of India Limited(ICICI)

- Unit trust of India (UTI)

- Small industrial development Bank of India (SIDBI)

- National industrial development corporation and (NIDC)

Conclusion

In conclusion, Finance from a commercial bank or bank financing provides short term and medium-term finance for your business. I also share with the types of bank financing.

So, guys, I hope, I solved your problems regarding Finance from a commercial bank or bank financing with relevant images.

Also read my further blogs related to finance:

SOURCE OF FINANCE FROM PREFERENCE SHARES

FAQ

A. Current accounts are provided by the Commercial banks for overdraft facilities. This account is for business purposes only.

A. Bank financing is short and medium term finance.

The money market is a highly organized market where monetary transactions for short term financing are affected by the process of accepting deposits and lending money.

Blogger | content writer | Learner.

A commerce student from Kolkata.