If you are planning to invest in the share market then you must read this blog before investing. In this blog, I have talked about all the order types in the share market.

An order is an instruction that an investor gives to buy or sell stocks on a trading platform or to a stockbroker.

In this blog we will learn the following order types:

- Market order

- Limit order

- Stop-loss order types

- Bracket order (BO)

- Cover order (CO)

- After market order (AMO)

- Good till triggered (GTT) order

- Validity

- Conclusion

- Q&A

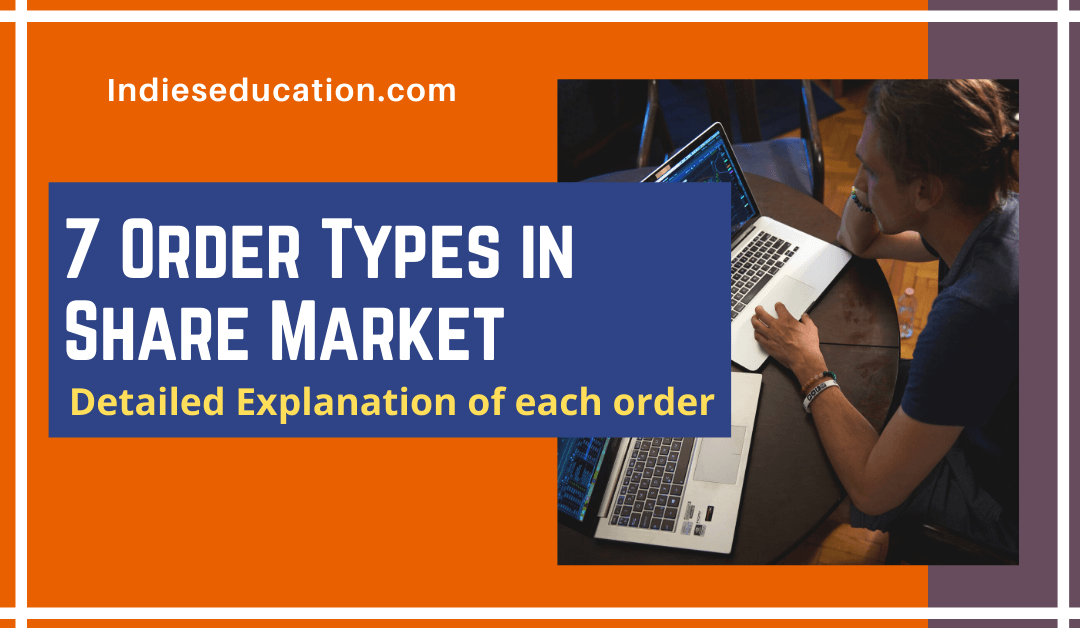

Market Order

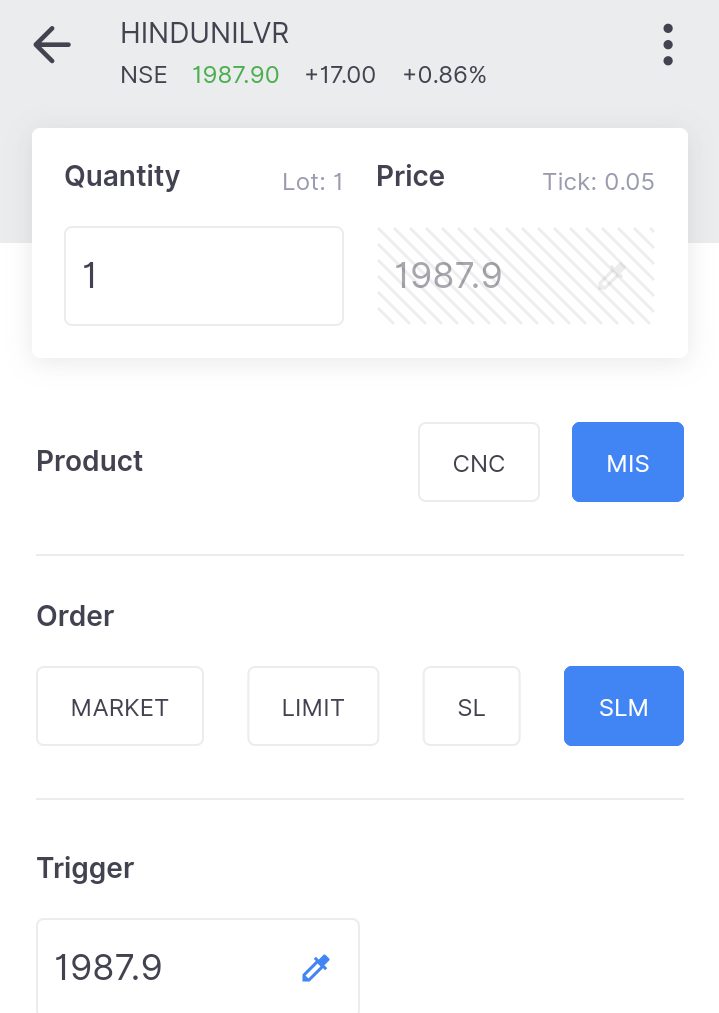

It is one of the order types where you can sell or buy shares at the current market price. Here, you cannot change the price. You have to buy or sell at the current market price.

Ex. You place a market order to buy a share of reliance and at that time its price is 1200, then you will get the share at Rs.1200.

It is the fastest way to buy and sell a share.

in the above picture you can also see option of MIS and CNC, MIS mean intraday trading and CNC means delivery trading.

If you want to know more about intraday and delivery, you can read my blog on types of trading styles.

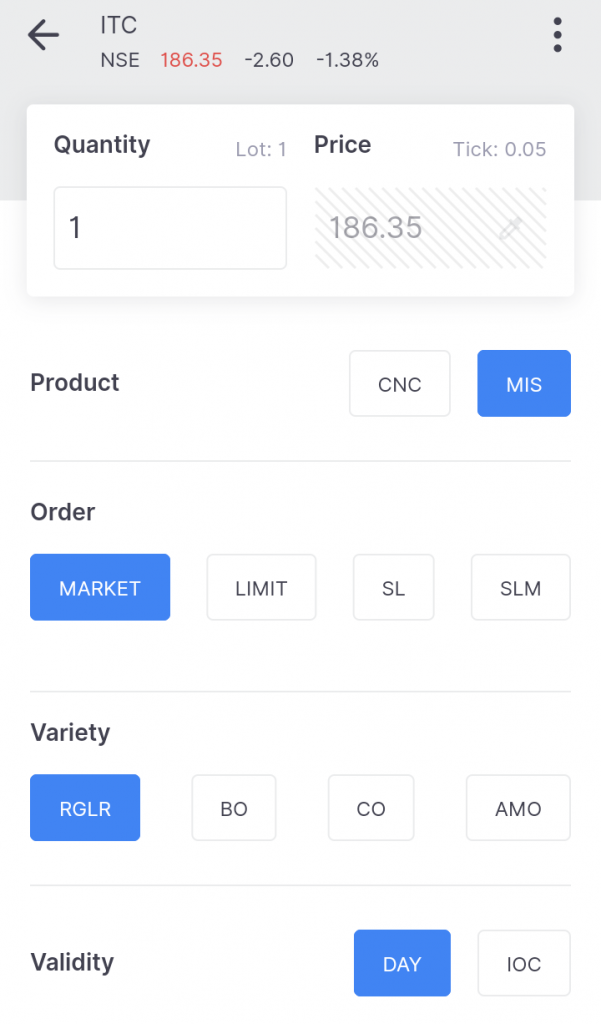

Limit Order

In this type of order, you can specify a price you want to sell or buy a share and if that price hits, (means the price of a share reaches your specified price) your order will be executed.

Ex. You want to buy a share of reliance at 1190 but the market price at that time is Rs.1200 then you can use a limit order to place the order at that price. If the price of the share reaches that value i.e. 1190, your order would be executed.

There is no guarantee for this type of order if it will execute or not as the execution of order takes place only when the price you specify hits.

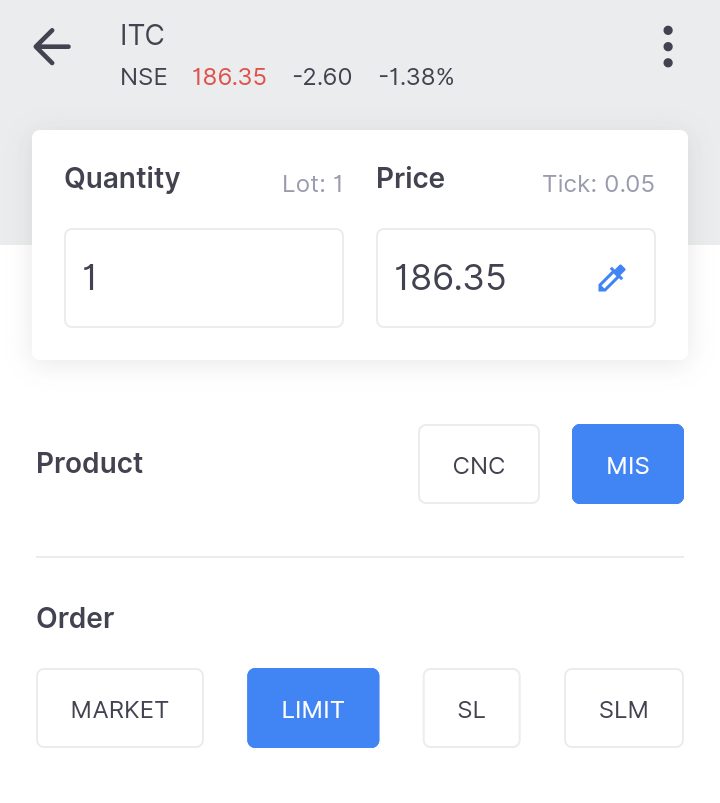

Stop Loss order types

A stop-loss order is an order which you can place in a stock market to reduce your losses, in a situation when the market goes against your trading strategy.

For example, you buy a stock at Rs.500, by applying stop-loss at Rs.490 which means your share would be sold if the price comes down to 490, to limit your loss as you cannot bear the loss greater than that.

There are two types of stop-loss orders:

1. Stop Loss Limit (SL) Order

In this type of order, you specify the price and trigger price and the trigger price should be less than price.

For example, You buy a share for Rs.1000 and place an SL sell order with price = 979 and trigger price = 980. In this case, if the price at which your buy share falls, your order will be sent to the stock exchange as soon as your trigger price i.e.980 hits and will be squared off at the next bid above 979. But, your share will not be sold at a price worse than 979 i.e. price you specify.

Now, let’s talk about its disadvantage. Suppose the market falls badly, that before your SL order executes, it falls below your specified price. As, we have talked about SL order will not be executed at a price worse than the specified price, then in this case your order will be open widening your losses.

3, Stop Loss Market (SLM) Order

In this stop-loss order you specify the trigger price only.

For example, you buy a share for Rs.1000 and place an SLM order with trigger price 480, then if the price of the share falls and your specified trigger price hits then your stock’s position will be squared off at the market price after the trigger price.

The above orders which we have discussed till now are regular order of share market, now I will be telling you the advanced orders that you can place in the stock market

Bracket Order (BO)

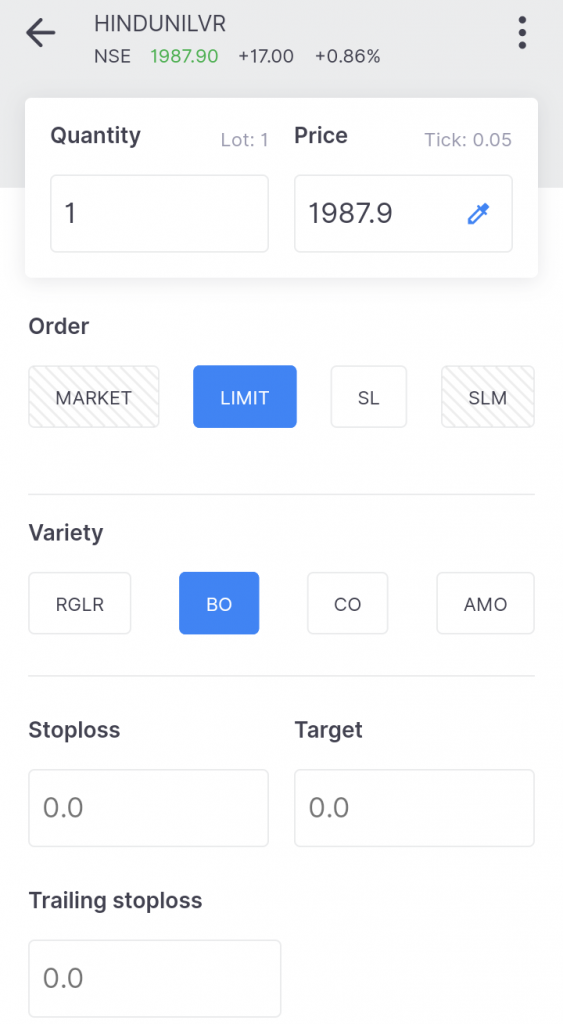

In this type of order, you have to specify target, stop-loss, and trailing stop-loss. Here, target means the profit you want to make, stop-loss means the maximum loss you can bear on that stock, let’s understand this with the help of an example. I will talk about trailing stop-loss a little later.

Let’s say you want to buy a share for Rs.1000 by placing a bracket order, you want Rs.50 profit and you can bear maximum Rs.20 loss. So, for that you will fill Rs.50 in target and Rs.20 in stop-loss.

Now, we will understand the option of trailing stop-loss which is optional for traders to specify.

If you have specified trailing stop-loss as 1, it means if the price increases from Rs.1000 to 1001, your stop-loss will decrease by 1 and now your stop-loss will be 19 but its opposite is not true i.e. if price decreases then stop-loss will not increase it will remain same.

But there is a disadvantage of specifying trailing stop-loss that you will not be able to modify your order once you specify it.

In this order, you have to specify a price in which you want to buy a stock like limit order.

Some important points to note about Bracket order is that it can be only used for intraday trading, and it is not allowed on BSE, MCX, currency, and options stocks.

In this order you get higher leverage than intraday trading as there is a predetermined stop-loss.

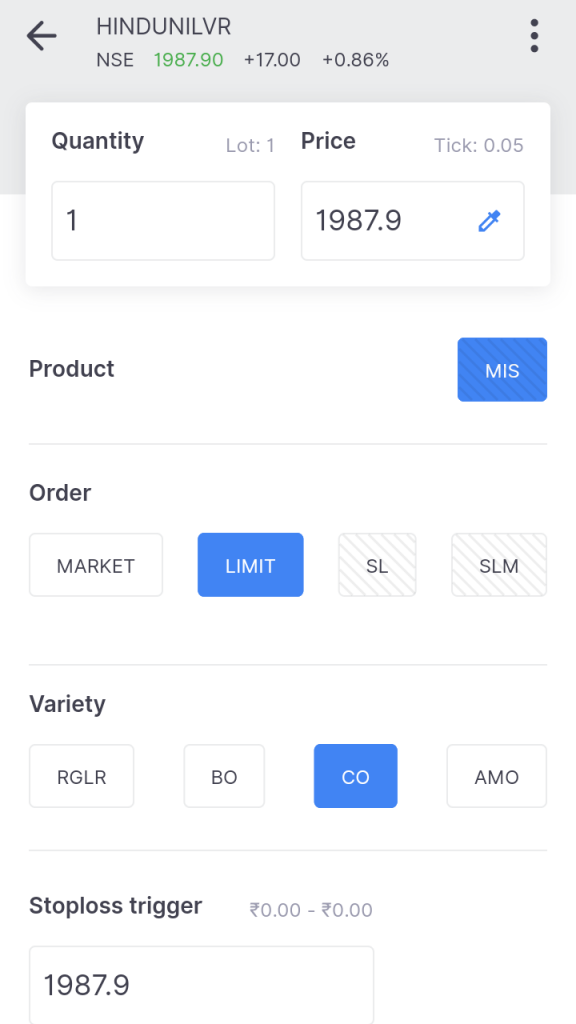

Cover Order (CO)

In this order, you have to specify the stop-loss trigger which is compulsory unlike of bracket order. Here, also you can specify the price in which you want to buy the share like a limit order. You cannot cancel a CO order once you place it.

Now, I will help you understand it more clearly with an example. Let’s say you want to buy a share of Rs.1000 by placing a cover order. You have to compulsorily mention a stop-loss trigger to place your CO order.

The range of applying a stop-loss trigger can be 1.5% from the price you enter the stock, in our case the range of stop-loss trigger can be from 1085-1000.

In this order, the leverage given is higher than intraday trading as by applying stop-loss you limit your losses.

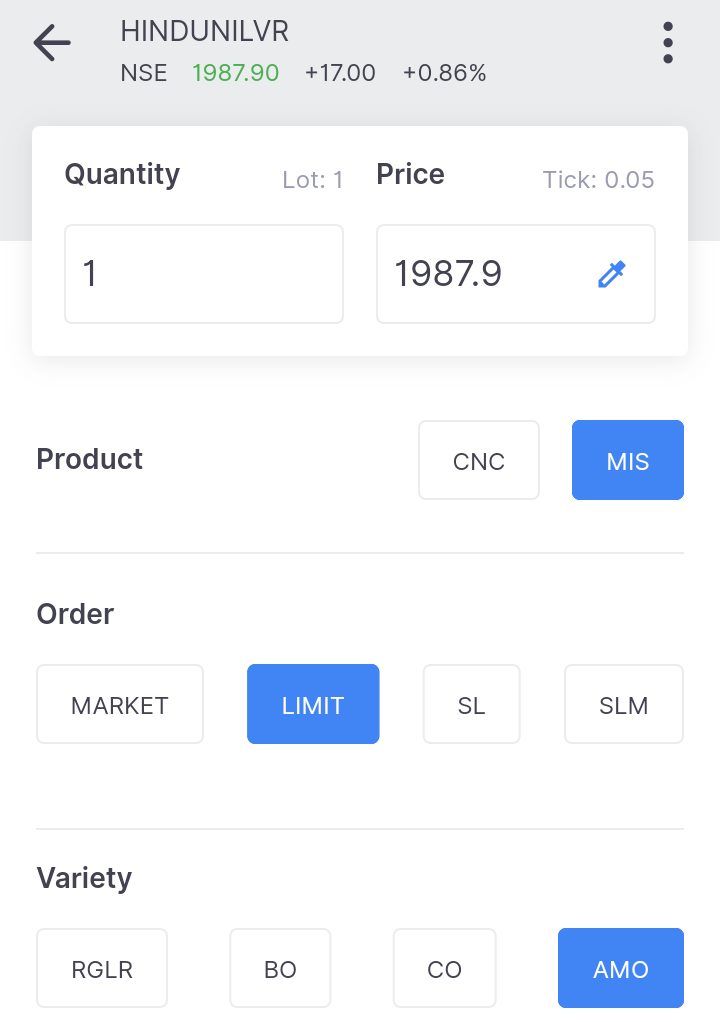

After Maret Order (AMO)

You can use this order, when you are not able to buy stocks in the trading time and you want to buy for the next day. You can place this order from 3.45 p.m. to 8.59 a.m. of the next day.

Here, you can decide the price in which you want to buy the stocks and if that price hits the next day, then your shares will be automatically be purchased. That’s its disadvantage also as your order will only be executed if that price hits the next day.

Good Till Triggered (GTT) order

You can place this order when you think that the price of a share is high and it can get to its right price after some months.

At the time of placing a GTT buy order, you can specify the trigger price and the price you want to buy the share. In case, when the trigger price hits but the price does not reach the price specified then in this case your order will get cancelled at the end of that particular trading day in which trigger price hits.

In the GTT sell order, you also get an option of OCC where you can also specify stop-loss along with the price at which you want to sell the share.

GTT order is valid for only 1 year. You can maximum place 50 GTT orders at a time. GTT orders also get canceled due to corporate action like stock split, dividend, etc.

Validity

Validity means the time till which the order you place will be valid. There are two types of validity:

Day Validity

Day validity means your order will be valid for the whole day on which you place the order and if the price hits your order will get executed.

IOC (Immediate or Cancelled)

In this type of validity, the portion of the order which can execute immediately will execute and the left portion will be canceled. Ex. You place an order for 100 shares and you got a seller for 40 shares, then in this case 40 shares will be executed and the left 60 shares will be canceled.

Conclusion

After reading the blog, I wish you have understood all order types in share market. But before investing in share market, you must choose a trading style.

If you want to know more about trading styles, you can read my blog on types of trading styles.

Q&A

Ans. Yes, you can place pre-market order in zerodha. You can place orders in the first eight minutes of the pre-opening session i.e. from 9.00 to 9.08 a.m.

Ans. Yes, you can cancel and modify a market order. You cannot only cancel the market order between 9.08 and 9.15 a.m. in the pre-opening session.

Ans. limit order expires at the end of the day trading session. They are not carried to the next day.

Ans. yes, you can cancel and modify a limit order. Similar to market order it cannot be canceled between 9.08 and 9.15 a.m. during the pre-opening session.

I am a student currently pursuing B-tech in electrical engineering from Delhi Technological university.