Unlike in the past, accounting statements are largely needed by owners. These days various parties needed the accounting statements. Like investors, creditors, banks and many others, who have an interest in the business. Let’s learn how principles of accounting work.

Principles of accounting refer to general guidelines and rules that Companies had to follow in order to prepare their financial accounts.

Accounting statements disclose the profitability and position of business to various parties. Therefore, it is necessary that these statements should be prepared by some standard, language and set rules.

Generally, Accountants accept these principles and other parties all over the world as general guidelines and rules for preparing the accounts.

These principles have developed on the basis of historical precedents and regulations of government agencies. Therefore, These rules generally called GAAP (General accepted accounting principles).

What you can expect:

Lets understand it with a example:

We all know that there is always a head (Principle) in school and regulates all the school. All teachers, staff, and other people follow the guidelines issued by Principle. So that school runs in a good way.

These guidelines are like staff selection for different subjects, fixing timing for lectures.

Likewise, all companies and empires in a economy had to follow issued rules and regulations in order to survive in a economy.

But if there are not any principles exist, the scene should be; In school, If there are not any rules regarding lectures and staff. Any teacher would go in any class to teach any subject.

It makes all school live in confusion. Nobody will believe in that school.

Unlike the school, Having a scarcity of rules, all companies maintain their accounts in their own way. Nobody will understand due to different assumptions.

That’s why Principles are so important.

Need of Principles of Accounting :

In order to make the accounting information meaningful to its internal and external users, it is significant that such information is reliable as well as comparable.

The information required to see the performance of the firm. It also compares to other firms and also to its previous years.

This is only possible if the financial statement’s information is based on some set of rules known as principles and conventions.

These rules bring uniformity and consistency to the process of accounting. It enhances its utility to different users of accounting information.

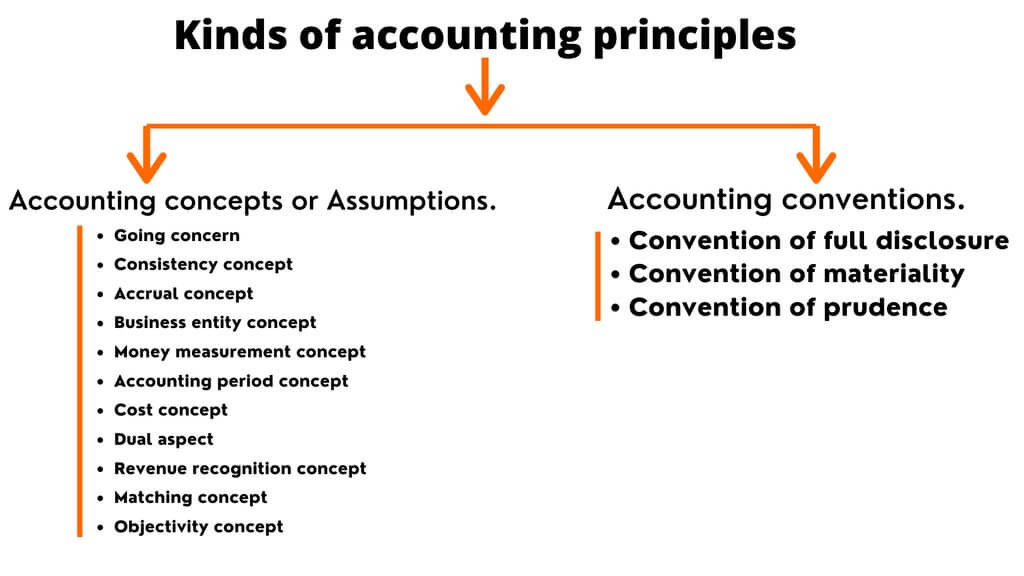

Kinds of Principles of Accounting:

- Accounting concepts or Assumptions.

- Accounting conventions.

Concepts or Assumptions of Accounting:

It helps to make the accounting language convey the same meaning to all people and to make it more meaningful.

Most of the accountants agreed on a number of concepts and usually followed for preparing the financial statements.

These concepts provide a foundation for accounting process. No enterprise can prepare its financial statements without considering these basic concepts or assumptions.These concepts guide how transactions should be recorded or reported.

Following may be treated as basic concepts or assumptions :-

- Going concern concept

- Consistency concept

- Accrual concept

- Business entity concept

- Money measurement concept

- Accounting period

- Cost concept

- Dual aspect

- Revenue recognition

- Matching concept

- Objectivity concept

Going concern concept :

As per this, it assumes that business will continue to exist for a long period in the future. The transaction recorded in the books on the assumption that it is a continuing entity.

In this concept, we record fixed assets at the original cost. Therefore, depreciation would be charged without reference to market value.

For example, if machinery purchased would last, say, 10 years, for calculating the net cost of machinery, it will divide into the next 10 years for calculating the net profit or loss each year.

Consistency concept:

It states that accounting principles and methods should remain consistent from one year to another year.

These should not be changed from year to year, in order to enable the management to the P&L A/c and Balance sheet of the different periods to draw important conclusions about the working of the enterprise.

For example, a firm can choose any one of the several methods of depreciation i.e. straight line, written down, or any method.

Accrual concept:

The accrual concept always used to record transactions. It provides more appropriate information about the performance of the business enterprises as compared to a cash basis.

In the concept, revenue always recorded when sales made or services rendered whether money received or not.

Similarly, expenses recorded in the accounting period in which they help for earning the revenue whether the cash paid or not.

Thus, all expenses and incomes relating to that period are recorded to ascertain true profit or loss. Also to show the true financial position at the end of each year.

Business entity concept:

In this concept, Business always treated as a separate unit from its owners, creditors, managers, and others.

Business units should have a completely separate set of books and we have to record business transactions from the firm’s point of view, not from the view of the proprietor.

Money measurement concepts:-

Accounting only records monetary (in terms of money) transactions and events.

For example, Accounting does not record a quarrel between the production manager and sales manager.

These facts or happenings cannot be expressed in money terms. Thus it will not be recorded in the books.

Accounting period concepts:-

As the business is intended to continue indefinitely for a long period. The true results of the business operations can be ascertained only when the business is completely wound up.

But ascertainment after a very long period will be used little to owners, management, etc. Because it will be too late to take steps to improve it.

Thus, the entire life of the firm is divided into time intervals. Meanwhile, Twelve months is usually taken to measure the profits.

Cost concept:-

For example, If a business purchase a building for rs.1,00,000 which would be recorded as same as market value. Hence, a subsequent increase or decrease in market value will not be recorded in the business.

Two years later, the value of the building increase to 5,00,000. Therefore, the shoot up value will not be recorded.

From this example, We can conclude that, an asset is ordinarily recorded in the books at the acquired cost . This cost is subsequent to the basis of all accounting.

Dual aspect concept:-

According to this concept, Every business transaction records as a dual aspect. In other words, every transaction affects at least two accounts.

If one account is debited and any other account must be credited, called the Double entry system.

Revenue recognition concept:-

This concept determines the time or particular period when the revenue is realized.

It is deemed to be realized when the ownership of goods is transferred to the purchaser. When he has legally become liable to pay the amount.

For example, If a firm gets an order of goods on 1st January and supplies the goods on 20th January. It receives cash on 1st April. So, The revenue earned will be considered on 20th January as the ownership of goods was transferred on that day.

Matching concept:-

According to this concept, At the time of determining the net profit from an entity, all costs which are applicable should be charged against that revenue. Therefore, This concept is very essential for the correct determination of net profit.

Accordingly, for matching, costs incurred should recognized for generating that revenue.

Objectivity concept:-

This concept ensures that accounting transactions should be recorded in an objective manner i.e. free from the personal bias of either management or accountant who prepares the accounts.

It is possible only when verifiable documents support each transaction such as cash memos and sales bills, etc.

For example, when the goods are purchased for cash. Cash receipts must support the transaction for money paid.

Accounting Conventions:-

It may be defined as a custom practice that is adopted either by general agreement or common consent among accountants.

Following are the main conventions of accounting:-

- Convention of full disclosure

- Materiality Convention

- Convention of prudence

Convention of full disclosure:

It states that all significant information regarding economic affairs of business should be completely disclosed.

The principle is so important that the Companies act makes enough provisions for the disclosure of essential information in the financial information of a company.

Convention of materiality:

It is an exception of the convention of full disclosure, items having an insignificant effect or being irrelevant to the user should be disclosed.

So, unimportant items have to left out or to be merged with other items.

For instance, the cost of small tools may be important for a small repair workshop. But the same figure may be unimportant for big companies.

Convention of prudence:

According to this convention, all anticipated losses should be recorded. But, all anticipated or unrealized gains should not be recorded.

Provisions are made for all known liabilities and losses even though the amount cannot be determined certainly.

Conclusion:

That’s how Principles of accounting made the accounting easy. If there was no principle then the scene would be very worst and the business does not grow properly.

Content Marketer