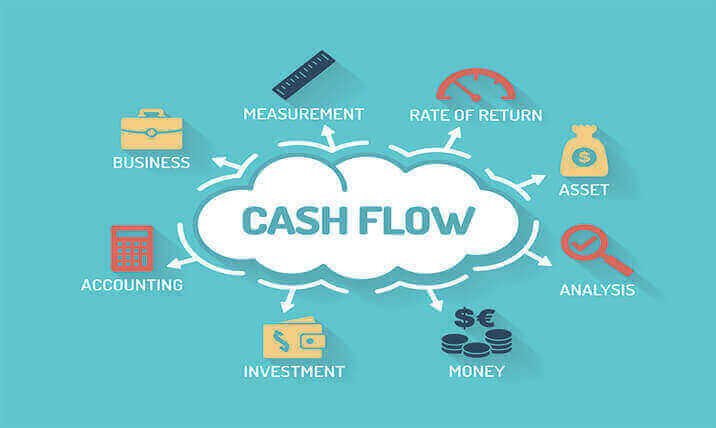

As its name suggests cash flow is the movement of money. This could be in business or in personal life. What actually cash flow does is that it helps you in managing your cash.

Cash flow is assumed to be very important in personal life as well as in business too because it keep you a track of record of your money as money is the king you may have heard many companies and person faces bankruptcy and that’s because, they ran out of cash.

They may have many business empires and could have net worth of thousands and millions of bucks but still face bankruptcy because they don’t have cash to pay their expenses. It believed that “Cash is the king” having cash in hand will always get you out of every problem.

Cash flow doesn’t refer to in and out of money, it basically refers to evaluating components of money that where the money comes from, where it goes and choices for living a satisfactory life.

Types

Flow of cash can be of two types either positive or negative. When it comes to type of cash flow then it is basically of two types which are:-

Personal cash flow

Corporate cash flow

When I wanted to knew about this concept of cash flow, I have reached a lot and found some data’s on corporate cash flow but couldn’t find a lot about personal finance.

So I want to share with you what I have learnt till about cash flow. I will tell you about both type of cash flow but my main focus will be on personal cash flow.

Personal cash flow

Someone has said right about personal finance that “if you can’t measure it you can’t manage it”. Do you get surprised often when your credit card bill arrive that you have spend a lot of money. But don’t worries, managing your personal financial i.e cash flow will solve things for you.

When I cane to know about this aspect I laughed a lot that how does maintain his personal financial statement but when I went deeper to this concept I was just shocked.

Components

Now to measure your personal cash flow there are some components which are essential to be take care of, they are:-

- Income

- Salary

- Over-time

- Bonuses

- Fixed expenses

- Rent

- Electricity

- Gas

- Utilities

- Internet

- Credit card

- Cell phone

- Controllable expenses

- Extra home expenses

- Clothes

- Food

- Entertainment

- Taxes

- Income tax

- Savings

- Savings account

- Investment

Easy ways to increase your personal income

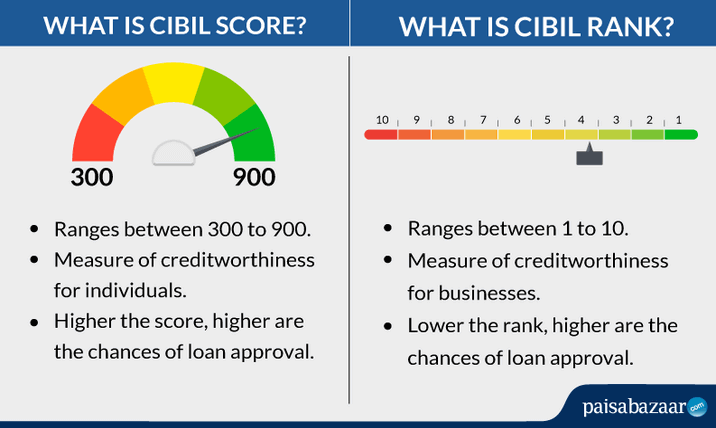

- Keep credit rating high

When you go to buy anything in market on credit they at very first check your credit score. Their methods of checking your credit score might differ but objective is same to check can you pay him all the money back or not.

So here are some very easy steps to maintain your credit score, but remember cash flow is must:-

- Pay your bills on time: – While checking your credit score paying bill are very important as everybody will ask other that did he pays you on time so bills could be like electricity bill, water bill, even grocery bills, your loan installments etc. Go try to pay them as soon as possible.

- Try to use credits in emergency only

- Try to keep your credit card low

- Manage food and dining bill when going out

Most of our expenses occur when we get out for dine or food because your expense meter start as you have travel expenses and then dining expenses.

I don’t say don’t to dine or don’t to eat outside food but yes try some places according to budget and not to increase your budget with any reason.

- Plan budget hangouts

That is again a main expense where spend a lot. When we get out for hangout we automatically thinks of eating at expensive places and spend a lot but that doesn’t actually hangout mean it basically means when you enjoy with your friend it haven’t mention anywhere that eating in expensive places mean hangout.

So do some low budgets hangout to save money. Just give it a second and think that how much you spend on your last hangout. And for that cash flow will help you

- Side hustle

A side hustle means to have earning side by side of your main income. You can do some additional activities to earn money when you aren’t in your job.

You may run some coaching classes, or maybe you can be baby sitter for your neighbour, you could be a freelancer there are tons of jobs available that you can pursue and the amount you will get by this will be a lot more precious than your primary income.

- Reduce variable/living expenses

Living expense is too a very big amount of expense because living expenses are on an expensive side. And just one wrong decision can screw you out.

There are many items which we not required at our home or flat but still we buy them and that reason could be anything. You have to chose things wisely which you wanted in your living space.

And yes don’t let your heart decide it for you, let your brain decided that do you really want or not.

- Rental income

Another source of income could be your by renting some items unused by you.

Let’s assume that you have a spare video game with you then you can rent it to someone in your neighbour to play, theses type of situation is suitable for both you and the user as he can have some temporary happiness and you are earning by doing nothing.

And you may too lend a land or apartment to someone if that’s not used by you, this can generate you a great amount of money that can fulfill your great demands.

- Dividends and interest

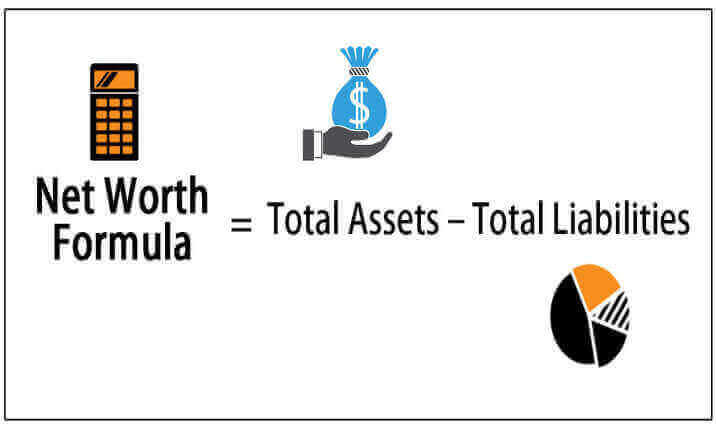

Investing your savings can benefit you a lot as it can create your net worth. Through it can multiply your money overtime without doing anything.

And with that it can provide dividends, interest form in short time. Different type of investment provides you some short term earning too.

Net worth

Personal finance management helps you building your net worth. None of your business or your job can build your net worth but personal finance will.

But net worth could be build by managing your personal finance and investing your savings to appreciate it not to depreciate it.

Corporate cash flow

Corporate cash flow reflects financial transactions and position of the company. It’s being assumed that your cash flow is more important than your revenue in corporate.

And it is so because sometimes businesses faces issue like they don’t have cash in hand to major expenses like salary but your revenue is very high and recurring.

So this suggests that having a running cash flow is more important than your revenues. You can deal this situation by controlling your cash coming from revenues coming in by just not spend it immediately and doing a plan of payments you have to make.

Components

- Assets

- Liability

Assets refer to receipt which can be liquidated. Liquidate means that anything from which you can make money for example machinery, goodwill etc.

Liability is those payments which company have to pay towards their creditors. For example Debenture holder, creditors, loans etc.

There are 3 types of cash flow:-

- Cash flow from operations

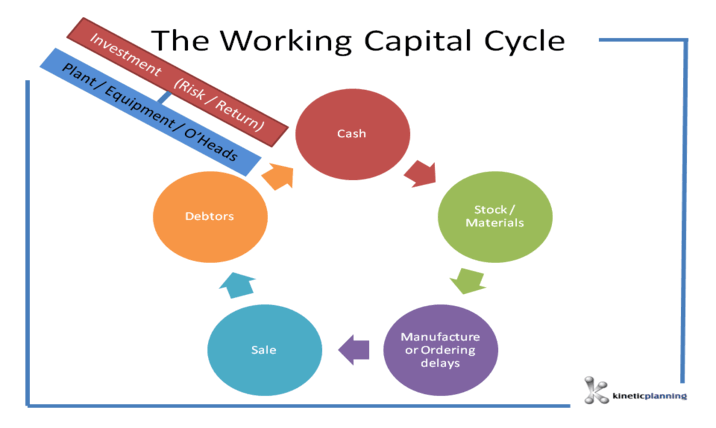

It refers to the cash getting in and out from our main activity of business, like in manufacturing industry, purchasing raw material and getting it sold in market cash from these type of activity will be considered as cash from operations.

- Cash flow from investing

This movement of money occur when company itself has invested his money to any other stock or have shares of some other company.

- Cash flow from financial activities

Basically to start any company there’s some cash involved in it whether it could be of any creditor or any other stake holder so the movement of cash between firm and any type of its creditor been included in this.

Net worth

There’s very simple thing to check your company’s net worth is just to check your value of assets of value you had in your company. Increase in the value of asset will directly increase the value or can say net worth of your company.

Conclusion

I think now you must have got to understand what cash flow is and how it works. But now it’s time to get this theoretical knowledge be applied in to your life practically because these components vary from person to person.

So hope you love to read this and you will apply this because it will make you let more things know as we do learn things more thoroughly when we do that.

At last, will say that just try for it as it will make you in habit of planning personal finance.

https://indieseducation.com/ultimate-guide-for-investing-as-per-your-age-2020/

https://indieseducation.com/secret-behind-every-rich-person-is-compounding-2020/

https://indieseducation.com/things-you-dont-know-about-debt-2020/

https://indieseducation.com/secrets-of-wealthy-triangle-2020/

https://indieseducation.com/jumpstart-with-massive-financial-confidence-2020/

https://indieseducation.com/discoverwhy-is-personal-finance-important-2020/

https://indieseducation.com/ultimate-guide-to-earn-5-figure-income-2020/