Everybody want to earn money to became rich but most the people fail in doing as they aren’t aware about the actual steps that are required to make them actually rich there are hundreds and thousands philosophy available on internet.

I would say that all of them are true and accurate by their own way so what you going to do is to found the way which suits you and u think that’s it perfect for you and follow it passionately.

Table OF Content

- Brief About Wealthy Triangle

- 3 Parts Of Wealthy Triangle

- Scalable business

- High Income Skill

- High Return Investment

- Quotes

Brief About Wealthy Triangle

Everybody want to earn money to became rich but most the people fail in doing as they aren’t aware about the actual steps that are required to make them actually rich there are hundreds and thousands philosophy available on internet.

I would say that all of them are true and accurate by their own way so what you going to do is to found the way which suits you and u think that’s it perfect for you and follow it passionately.

So read this carefully as this could be the one which suits you best or to any other your loved being. So today I am not going to tell you about a philosophy or any bookish theory but about an experience of a person having 15yrs experience in financial business.

This theory was given be a famous high ticket closer Mr. Dan Lok. The concept of this wealthy triangle is discovered by him.

3 Parts Of Wealthy Triangle

This is called a wealthy triangle because you can start gaining wealth with these three things. Lets us now understand these 3 one by one: –

- Scalable business

- High Income skill

- High Return Investment

Scalable Business

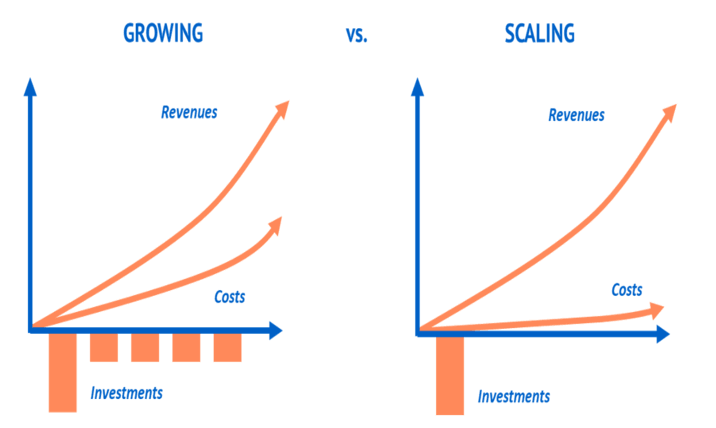

It is first part of our wealthy triangle. Not let us understand what scalable business is. Through the word scalable understand that every business is scalable, whether is it restaurant or a company but unfortunately that’s not true scalable business refers to a business which scales without any infrastructure.

For example for scaling your restaurant business you need to borrow or purchase a land then you need to construct or rent a property, you need to hire staff all the infrastructure. So that’s not scalable because it requires a huge cost to scale.

The business which is actually scalable is those which aren’t required of any particular space. Like cloud kitchen. For this you doesn’t need a particular place can deliver from any place to any place.

High Income Skill

A high income skill is basically an ability which is dictated by the market. A high income skill is the basic and most important step of wealthy triangle. Having a high income skill only can take you much far in life as this special; ability can make you survive in the worst situation.

For example like you have a high income skill called consulting and you own a consulting brand which took your all capital and unfortunately that business failed due to any reason now due to that skill you can establish that whole empire again by starting from start.

These skills aren’t normal they are valuable skills for example normally you being charged per day or per month but these professionals are paid in hours.

High Return Investment

last part of our wealthy triangle is High Return Investment, is well aware word which mostly everybody knows. People are becoming little aware about investing. Investing is a situation when you put your money somewhere like in bank etc in hope that it will increase the value you put in.

For example bank provides an interest rate which the depositor gets when he surrender some money in bank. Bank collect money in many ways like fixed deposit, saving account etc.

There’s isn’t a single way to invest, there are plenty of options available like stock market, mutual funds, bank, angle investing, lending money, real estate etc.

Now where the problem lies is in lack of knowledge. People now knowing about investing invest money in stock market or mutual funds and then after losing that money blames to stock market. The fault is in them but they blame ultimately to stock market knowing that totally theirs fault. These investments help you in achieving your long term goals.

For high return investments your interest must be at least of 10%p.a.

Now let us understand what the co-relation between them is.

High income skill acts like a stable platform for you which will always be able to generate income for you without noticing that what stage of life you are at. Now high income skill will generate you a lot of income and that income can be diversified into investments and scalable business. And then scalable business will give you a cash flow that can too be invested.

Investment is really important because it helps you creating your net worth which is the value you will likely to increase to be rich.

So basically

Income from high income skill involved in investment and scalable business and maintaining cash flow from scalable business.

But if you basically see there’s not nay particular use of scalable business in this wealthy triangle. My point of view on this is if some have a high income skill and does a high return investment can become wealthy easily.

While investing or in normal life you have to take care of 1 thing always that

“It’s not what you do,

It’s how you do”

But now I have stated that in reference to investing especially as I have seen many a people start investing after listening to me without studding about it. For example there are people like rakesh jhunjhunwala in India who earn most of his wealth from share market in India. He is the god of investing in India. As in India there’s no one else of jhunjhunwala who is India’s biggest billionaire in investing.

Now let us know some detail about investing

When we talk about investing there are basically 2 factors involved in that and that is: –

1. Return on investment

2. Risk involved

ROI (Return on investment)

Roi is the amount you get in return of giving a certain amount to someone in order to increase its value. For example ujjivan small finance bank give a roi of 8%p.a. on fixed deposit.

Now let’s assume that you have a fixed deposit of 1cr in bank. So you will get 8l as an interest in your account every year. That’s the rate of return. Many of people get attract to companies giving high return on investment in share market and then we lose all the money in it.

Because who doesn’t know how to actually invest in sake of return only.

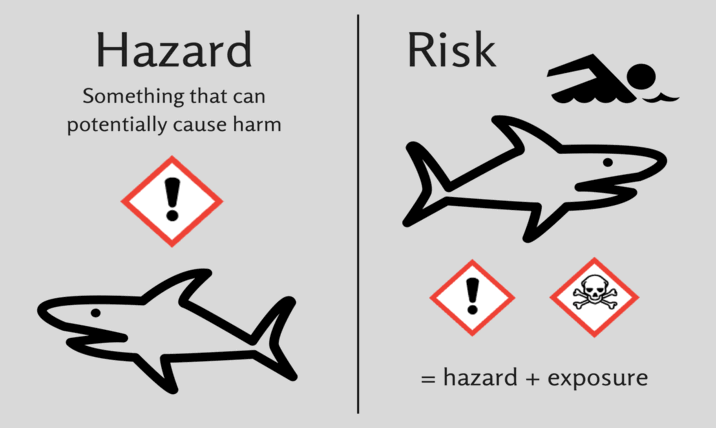

Risk

Risk is the possibility of bad happening. Many people invest in vey risky shares as they are taught that high risk leads to high returns. Yeah that’s true but this deal is for people who have loot of money spare who do not have any regret of losing their money.

Beginner investors should always invest in shares which are at low risk. Acc to people risk is actually the chances of downfall in a company but acc to me actual risk in share market is of getting invested in company blindly. I think no can do such a big blunder then this.

You should always invest in company whose business model is understandable by you. Your capital is the most important to you to invest it wisely.

Quotes

Here are some powerful quotes on investing by god of investing warren buffet: –

“Buy when everybody sells,

Sell when everybody buys”

Through this he basically wants to get you out of rat race of people where people think to buy when market is on top and to sell when everybody sells. As basically we must do opposite of that to earn profit. As you must buy when everybody is selling as market will be on lowest so you will get shares at cheap. And sell them when market is on high to earn profit.

“Be an saving asset,

Until becoming an earning”

These are the most beautiful lines which says to child who wants to invest but couldn’t earn that save your parents money in household and business until you start earning and spending money by your own. For example usually our mothers get send us to bring some grocery or vegetables form market so you can bring that same in as low as possible and can start saving them.

“Rule #1 is never lose money,

Rule #2 is never forget rule #1”

This quote is also important to be in mind while investing that you can do survive with low interest rate but with losing money at all especially when you are a beginner. You always have to take care of your principle amount because if it slips from your mind even for a second then you may lose your capital and remember life doesn’t have a rewind or undo button.

“Price is what you pay,

And value is what you get”

Price is a very naughty amount that keeps on fluctuating up and down. But there is value which depicts its actual worth.

For example an apple in its season be sold at Rs.10/kg but ion off season its value increase to Rs.50/kg. Its price keep on fluctuating but the worth is still.

Now what you think its value should be? 40? Or 30? Or maybe 25? May be 10? So always find the value of shares rather playing on its price.

So I hope you may have understood what I want you to understand hope you will apply this rather then continuing your normal back life.

https://indieseducation.com/rules-of-cash-flow/

https://indieseducation.com/ultimate-guide-for-investing-as-per-your-age-2020/

https://indieseducation.com/secret-behind-every-rich-person-is-compounding-2020/

https://indieseducation.com/things-you-dont-know-about-debt-2020/

https://indieseducation.com/jumpstart-with-massive-financial-confidence-2020/

https://indieseducation.com/discoverwhy-is-personal-finance-important-2020/

https://indieseducation.com/ultimate-guide-to-earn-5-figure-income-2020/