Do you know what is Venture capital? you might or might not know, what is venture capital.

Hopefully, by the end of this blog, you would be able to understand what is Venture capital and I also share with you the short term sources of finance.

There is another form of equity or debt financing designed especially for funding high risk and high reward projects known as venture capital.

What is venture capital?

The term ‘venture capital‘ refers to capital invested in a business or industrial enterprise which carries the elements of risk and insecurity and the chances of business hazards.

In other words, venture capital as a source of long term business financing has emerged as a necessity for the potential growth undertakings of new entrepreneurs.

What is finance from venture capital?

According to pratt, it may be referred to as “the early-stage financing of new and young enterprises seeking to grow rapidly”.

Thus, the risk involved in venture capital investment is high and shareholders may not get good results in terms of dividends, etc. But chances of capital gains may be there in the long run.

The investor or financer is known as’ venture capital firm’ or the ‘venture capitalist’ and the enterprise where investment is made is known as the ‘ venture capital undertakings’.

A Statutory company or a finance company or a mutual fund may act as the venture capitalist.

In short, They may invest their funds in a venture capital undertaking either in the form of equity share capital or as debt capital.

The venture capital firms ‘by financing the risky proposals’ can play a crucial and innovative role in the development of small scale enterprises.

what we gonna learn today:

- What is venture capital?

- Finance from venture capital

- What assistance venture capital provides?

- Example

- List of venture capitalists and start-ups funded by them.

- What are the Sources of short term finance?

- Examples of short term finance.

- Conclusion

- FAQ

The equity participation of venture capital firms generally does not exceed 49% of the total equity capital of the undertaking and hence the ownership and effective control remains with the entrepreneur.

As venture capital financing is risky, the venture capital firm should be very careful, analytical, and selective in financing the venture capital undertakings.

Before financing, the venture capital firm should take into consideration the feasibility, technical competence, commercial viability, managerial skill of the undertaking, etc.

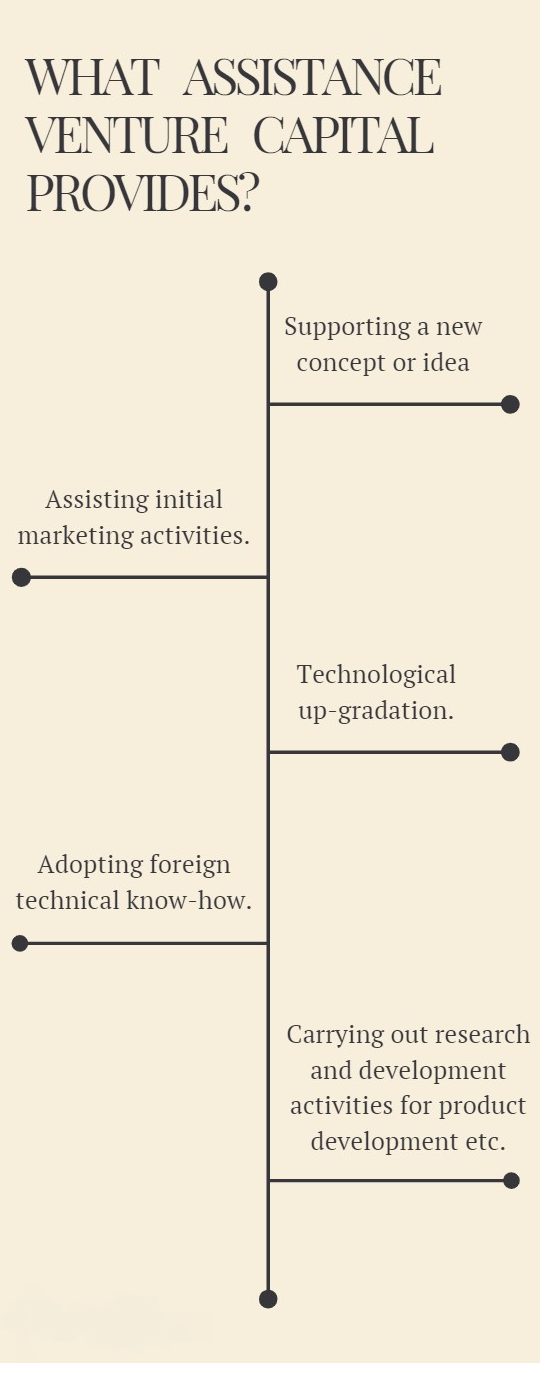

What assistance venture capital provides?

- Supporting a new concept or idea, i.e., development of new process/product.

- Assisting initial marketing activities.

- Technological up-gradation.

- Adopting foreign technical know-how.

- Carrying out research and development activities for product development etc.

Example of venture capital

In India, the idea of venture capital was first initiated by the industrial finance corporation of India (IFCI) with a view to assist entrepreneurs, particularly technologists and professionals who have skills but lack of finance.

Following are the List of venture capitalist and start-up funded by them:

| VENTURE CAPITALIST | START-UP FUNDED |

| Helion Venture Partners | Yepme, Makemytrip, Netambit, Komli, Taxi For Sure, and Pubmatic. |

| Accel Partners | Flipkart, Babyoye, Freshdesk, Book My Show, Zansaar, Probe, Myntra, and Commonfloor. |

| Sequoia Capital India | Justdial, Knowlarity, Practo, Iyogi, and Bankbazaar.Com |

Short term sources of finance

Short term sources are mainly used for financing the current assets.

Similarly, medium and long term sources are used for financing fixed assets.

Trade credit

When suppliers of goods and services allow the customer’s credit for a specific period to make payment, such credit is known as trade credit.

Trade credit period depends on certain factors, such as….

- Customs of the trade

- credit worthiness or repudiation of the customers

- cost of capital

- Degree of competition etc.

Trade credit is a spontaneous and more flexible source of financing because it arises from day to day business transactions.

Factoring

When an agent or merchant buys the invoiced debt, i.e. he buys the debtors from the firm requiring finance, it is known as factoring. The agent who buys the debtors makes a charge for providing finance.

In other words, The credit seller can obtain funds immediately after sales from the buyer or debtor. So, this method of short term financing is helpful to the credit seller.

The factor, i.e. The agent, Bank, financial institution, etc., fixes the credit limit, makes credit decision, collect receivables, and make payment.

The factor generally advances 60% to 80% of the face value of receivables with interest and charges his service fees or commission ranges from 2% to 5% of the value of invoices.

Meanwhile, if the customer fails to pay the debts, the credit seller has to make payment to the factor.

Bills of exchange

In this case, the seller draws a bill of exchange for a specified amount payable on demand or after a certain period of time on the debtor or customer.

The customer accepts the bill and returns it to the seller, i.e. drawer.

The seller can get the bill discounted by the bank through the Bill market by paying a discount charge.

Under this method, the seller gets payment before the maturity date of Bill. Accordingly. He can plan his production and cash budget.

This method of financing is limited to certain types of transactions. Moreover, this method is time-consuming and its cost of operation is also high.

Commercial papers

Short term unsecured promissory notes of large non-banking firms are called commercial papers or CPs. the firms who need short term cash may issue CPs.

CPs are purchased by other firms who have a surplus or excess cash to earn a higher return than other short term money market instruments.

In short, CPs provide a diversified source of funding to the borrower.

Commercial papers can be issued by a non-banking company for financing working capital requirements.

To sum up, CPs are low cost alternative to bank financing.

Bank loan

In this case Bank grants loans to the firms for a specified time to meet its working capital requirements. Bank grants each loan after negotiation with the borrower.

The amount of bank loan depends on the cash resources of the bank and the regulation of the monetary authority.

The bank loan system has a built-in system for reviewing the loan and its repayment but there is inflexibility in the bank loan system.

The rate of interest i.e. lending rate is also high. In short, a bank loan is a secure loan.

Accrued expenses and deferred income

Accrued expenses represent liabilities or expenses which a company has to pay for the services which it has already received.

Such expenses arise out of the day to day activities of the company and hence represent an impulsive source of finance.

In other words, Deferred income is the amount of funds received by a company in place of goods and services to be provided in the future event.

Since these receipts increase a company’s liquidity, they are also considered to be an important source of voluntary finance.

Bank overdraft and cash credit

in this method of financing, Bank allows short term credit to a firm under prior agreement up to a certain limit fixed in advance against securities like pledge, hypothecation, etc.

This method of financing tends to be cheaper than bank loans because interest is payable only on the actual daily balance of overdrafts/cash credit.

Above all, Bank financing is regulated by the RBI.

Advances from customers

Manufacturers and engaged in producing costly goods involving considerable length of manufacturing or time usually the demand to advance money from their customers at the time of accepting their orders for executing their contracts are supplying the goods.

In short, this is a cost free source of finance and really useful too.

Conclusion

In conclusion, venture capital as a source of long term business financing has emerged as a necessity for the potential growth undertakings of new entrepreneurs.

On the other hand, Short term source is the Source of finance that you have to repay within a period of one accounting year.

So, guys, I hope I solved your problems regarding Finance from short term sources and venture capital. I also use images and videos to make you understand.

Also read my further blogs related to finance:

SOURCE OF FINANCE FROM PREFERENCE SHARES

FAQ

A. Yes, when an agent or merchant buys the invoiced debt, i.e. he buys the debtors from the firm requiring finance, it is known as factoring.

A. Short term unsecured promissory notes of large non-banking firms are called commercial papers or CPs.

Blogger | content writer | Learner.

A commerce student from Kolkata.