Do you know what are mutual funds ? You might or might not know, but you would definitely be aware that

“Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.”

What does this mean?

If you would like to know what does this line mean and other basic concepts about mutual funds, then stay tuned, and Hopefully, by the end of this blog, you will be well acquainted with what is a mutual fund and its types.

What’s in it for you….

- 1> MUTUAL FUNDS

- 2> SOME ADVANTAGES OF MUTUAL FUNDS

- 3> SOME DISADVANTAGES OF MUTUAL FUNDS

- 4> TYPES OF MUTUAL FUNDS

- 4.1> ON THE BASIS OF STRUCTURE

- 4.2> ON THE BASIS OF ASSET CLASS

- 4.3> ON THE BASIS OF INVESTMENT OBJECTIVE

- 5> CONCLUSION

- 6> FREQUENTLY ASKED QUESTIONS (FAQ)

MUTUAL FUNDS

A mutual fund is an agency that collects money from the investors and invests them into stocks, bonds, money market instruments, etc.

These are operated by professional persons who have higher experience in the fields of the stock market and other market instruments.

These benefit the common man to invest professionally and gain higher profits from the same principal amount.

Basically mutual fund agencies collect a huge amount of money from a lot of small and unprofessional investors by taking a small amount from each of them.

They allocate this money into various different stocks and bonds, the profit or loss incurred by these funds has to be collectively born by all the investors.

Some Important Features Of Mutual Funds

Mutual funds usually charge annual fees called Expense ratios.

These provide an opportunity for small investors to invest money professionally and earn higher profits at lower risks.

When a person is said to buy any mutual fund, that person is actually paying for becoming a part of the portfolio of that mutual fund. The value of the mutual fund depends on the value of the stocks in its portfolio.

If the stocks are doing well (the fund is able to make a profit from the shares in its portfolio) then the price of the mutual fund rises.

Generally, a these funds show investment in various stocks rather than one stock.

The price of a mutual fund is called net asset value (NAV) per share (NAVPD).

NAV = TOTAL VALUE OF SECURITIES IN THE PORTFOLIO

OUTSTANDING SHARES are shares held by shareholders, company investors, institutional investors, or any insiders.

Generally, Mutual funds hold 100’s of securities and this makes diversification in its portfolio, this is impossible for a small investor with less financial resources.

Eg. You have bought 100 shares of Berkshire Hathaway, now if the price of this stock falls you will have to face a huge amount of loss, which would have been

Loss on 1 share X 100.

On the other hand, if you invest your money into 100 different stocks there would be reduced chances of NET LOSS, as despite the fact you lose money in 10 of your shares the other 90 will protect you from a net loss.

SOME ADVANTAGES OF MUTUAL FUNDS

1> PORTFOLIO DIVERSIFICATION

If you invest in these funds you are able to achieve diversification of your money into the right shares at a lower price. This reduces the chance of loss for investors.

2> PROFESSIONAL MANAGEMENT

If you invest in these funds you are able to get professional management of your money as professional managers are responsible to invest your money into different stocks of different sectors etc.

3>SIMPLICITY

These funds provide simplicity to the investors as they don’t have to surf for any reports and analytics of the companies.

On the contrary, if the investors themselves invest in the shares they might have to research the companies well before investing.

4> LIQUIDITY

Mutual funds are highly liquid. Liquid here means they can be easily converted into cash.

Eg. you have a car as your asset, now it takes very long to sell this car and convert it into cash.

Hence, cars are less liquid.

Whereas there is a huge demand for these funds hence they can be easily converted into cash.

5> COST

Mutual funds are very cost-friendly as they provide professional management at a very minimal cost, that of 2-3% or even less.

6> SAFE AND TRANSPARENT

It is a safe and transparent option, as it comes under the direct control of SEBI (securities exchange board of India) all the current rate of mutual funds and other required information is readily available on various sites.

SOME DISADVANTAGES OF MUTUAL FUNDS

1> DIVERSIFICATION

Diversification is an advantage as well as a disadvantage for mutual funds. As diversification of money into various different shares saves you from any major losses. It also keeps you away from any major gains.

2>COST

Cost is an advantage as well as a disadvantage for these funds as varying on different mutual funds, the cost of the transaction, as well as exit cost, is high, this should be well checked before buying any mutual funds.

3> NO CONTROL OVER PORTFOLIO

If you invest in these funds, you get professional management of your financial resource but, at the same time, you are not able to control your portfolio.

4> HIGH SALES CHARGES

Mutual funds have high sales charges as there are a lot of people involved in your transaction. This also includes various hidden charges, which are charged by mutual fund companies without any prior information.

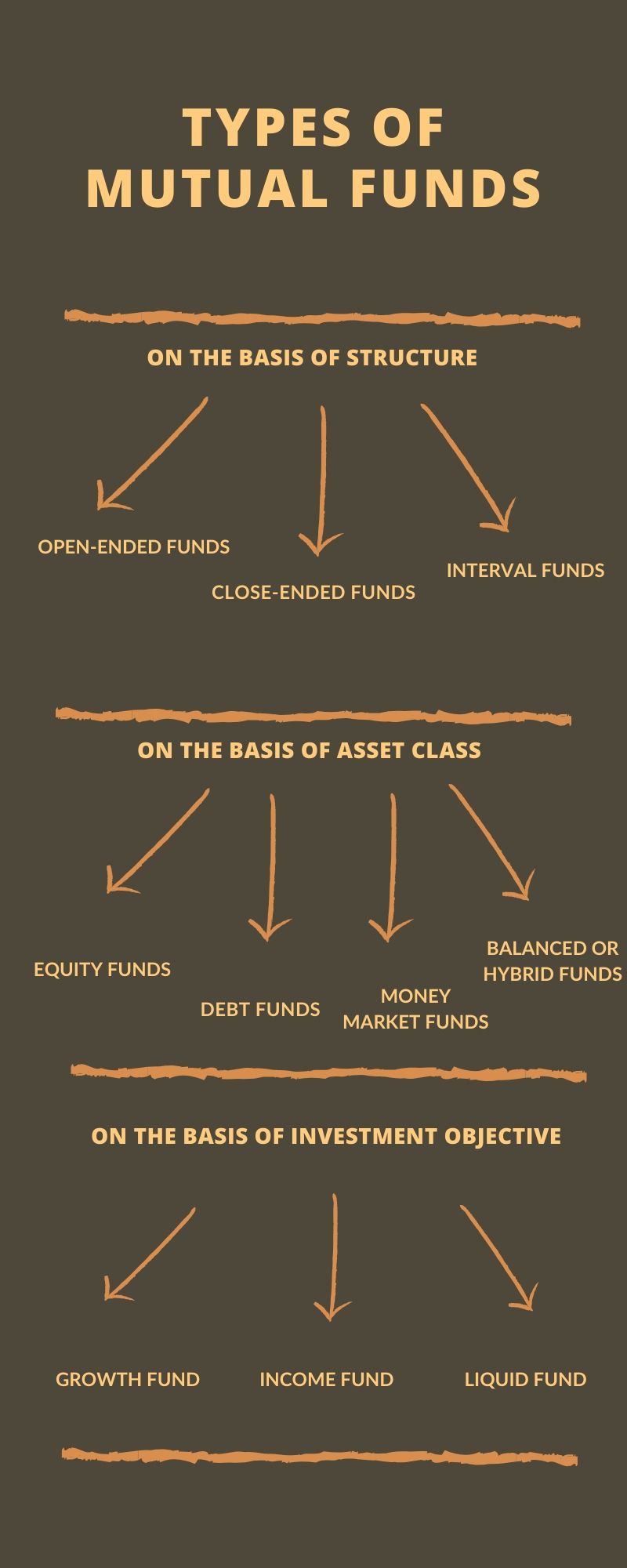

TYPES OF MUTUAL FUNDS

There are various types of mutual funds some of which are as follows →

ON THE BASIS OF STRUCTURE

1> OPEN-ENDED FUNDS →

open-ended funds are those funds where purchase and ale can be made throughout the year. All these purchases, as well as redemptions, are done at existing NAV’s. There is no limit to investment in this fund. Here, investors can withdraw their funds whenever they want, hence giving them the freedom of liquidity.

2> CLOSE-ENDED FUNDS→

The only buying source for these funds is an IPO and it cannot be sold back to the mutual fund agency, rather it is sold in the stock market at the prevailing stock prices.

3> INTERVAL FUNDS→

These funds are a mixture of closed-ended as well as open-ended funds these funds can be bought during an IPO but these can be repurchased by the mutual fund agency at various fund intervals, the mutual fund agency can buy the mutual funds back from the public or the investors can themselves offload the shares to the company, according to their wish.

ON THE BASIS OF ASSET CLASS

1>EQUITY FUNDS →

These funds invest the money into equity shares of different companies. These funds give a higher rate of return but the risk involved is very high.

2> DEBT FUNDS →

These funds invest in debt instruments like company debentures bonds, etc. hence there is a fixed rate of return and it is a safe investment option.

3> MONEY MARKET FUNDS →

These funds invest in a market’s liquid instruments like Treasury bills, commercial papers, etc. These are also considered as safe options.

4> BALANCED OR HYBRID FUNDS →

These funds invest in both equity as well as debt funds and hence provide a chance to gain higher returns and at the same time protect from chances of high losses. These funds because have both equity as well as debt hence the gain is balanced out

ON THE BASIS OF INVESTMENT OBJECTIVE

1> GROWTH FUND→

Under these schemes, funds are invested in buying equity (shares), these are a bit risky but provide a chance to gain high capital fund.

2> INCOME FUND →

Under these schemes, funds are invested in fixed market instruments, like debentures and bonds, it aims at the safety of money at the time of investment.

3> LIQUID FUND →

Under these schemes, funds are invested in short term funds like treasury bills and commercial papers, etc. with the aim to have liquidity

It also includes other funds like

- TAX SAVING FUND

- CAPITAL PROTECTION FUND

- FIXED MATURITY FUND

- PENSION FUND etc.

There are various other types of mutual funds.

CONCLUSION

From this blog we learn that

MUTUAL FUNDS

A mutual fund is an agency that collects money from the investors and invests them into stocks, bonds, money market instruments, etc.

ADVANTAGES OF MUTUAL FUNDS

1> PORTFOLIO DIVERSIFICATION

If you invest in these funds you are able to achieve diversification of your money into the right shares at a lower price.

2> PROFESSIONAL MANAGEMENT

If you invest in these funds you are able to get professional management.

3>SIMPLICITY

These funds provide simplicity to the investors as they don’t have to surf for any reports and analytics of the companies.

4> LIQUIDITY

Mutual funds are highly liquid. Liquid here means they can be easily converted into cash.

5> COST

Mutual funds are very cost-friendly as they provide professional management at a very minimal cost, that of 2-3% or even less.

6> SAFE AND TRANSPARENT

It is a safe and transparent option, as it comes under the direct control of SEBI (securities exchange board of India) all the current rate of mutual funds and other required information is readily available on various sites.

DISADVANTAGES OF MUTUAL FUNDS

1> DIVERSIFICATION

Diversification is an advantage as well as a disadvantage for mutual funds.

2>COST

Cost is an advantage as well as a disadvantage for these funds as varying on different mutual funds.

3> NO CONTROL OVER PORTFOLIO

If you invest in these funds, you get professional management of your financial resource but, at the same time, you are not able to control your portfolio.

4> HIGH SALES CHARGES

Mutual funds have high sales charges as there are a lot of people involved in your transaction.

TYPES OF MUTUAL FUNDS

There are various different types of mutual funds which are discussed as above.

1> ON THE BASIS OF STRUCTURE

2> ON THE BASIS OF ASSET CLASS

3> ON THE BASIS OF INVESTMENT OBJECTIVE

ALSO READ MY BLOG – HOW THE STOCK MARKET WORKS?

FREQUENTLY ASKED QUESTIONS (FAQ)

In a nutshell, mutual funds are safe. Investors should not be worried about short-term fluctuations in the returns while investing in them. You should choose the right mutual fund, which is sync with your investment goal and invest with a long-term horizon

For stock mutual funds, a “good” long-term return (annualized, for 10 years or more) is 8%-10%. For bond mutual funds, a good long-term return would be 4%-5%

There is no guarantee you will not lose money in mutual funds. In fact, in certain extreme circumstances you could end up losing all your investments.

A Blue chip fund is a term used to indicate well-established and financially sound companies. Blue chip funds invest in stocks of those companies that have a credible track record with sound financials along with regular dividend payments and profitability over the years.

Excellent work👍👍good luck