Do you know when your business starts to be profitable? If no, then read this article carefully, it will give you detailed information about the break-even analysis.

So breakeven analysis is a process where you can calculate when your business starts to be profitable.

WHAT’S IN IT

Definition of Break-Even Analysis

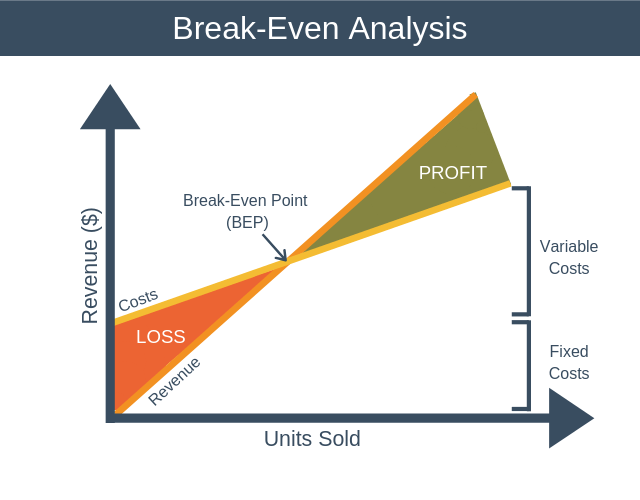

Break-even analysis is a process where you can find at what point your company starts generating profits before doing that business.

Or in another way how many products or services, you have to sell to get to a point where you at least recover your all costs.

It means this is the point where all costs and revenue remain the same.

And when the sales increase from that point, then the company becomes profitable, when it decreases then the company is at a loss.

Formula For Break-even Analysis

To calculate a breakeven analysis, we have to take a formula’s help.

There are two types of formulas we can use, one is for when we want to calculate how many units to sell.

And another is to calculate how much we have to sell in dollar value.

1st one is breakeven analysis is equalled to the fixed cost divided by the unit contribution margin.

Break-even analysis for units = The fixed cost / The unit contribution margin

2nd is, breakeven analysis is equaled to the fixed cost divided by the unit contribution margin and selling price per unit’s ratio

Break-even analysis for dollar value= The fixed cost / (unit contribution margin/selling price per unit)

Now, what’s this? What’s the meaning of fixed cost, contribution margin?

- Fixed cost – These are the fixed costs which the company has to pay every month, whether the company generates revenue or not. Like employee’s salary, warehouse’s rent, etc.

- Variable cost – These are the costs that may vary according to the company’s production ability. Like the electric city, raw materials, etc. Which we can use as per their requirements.

- Unit contribution margin – If we remove our variable costs from a product’s price, then the remaining price is called the contribution margin.

Let’s understand by an example, If we have a product and its selling price is $30, and here our variable cost is $20. Then our contribution margin of that product is $10.

And knowing any product’s contribution margin is very important. Because by knowing this, we can know that we are selling our products at a high price or a low price.

- Selling price per unit – This is the full price for a single product.

Steps to calculate Break-Even Analysis

We can calculate the breakeven point in two ways. The first way is for how many units to sell, and the second is for dollar value.

To find a breakeven point first, we have to calculate all our fixed costs and variable costs. And then we also have to calculate the unit contribution margin.

After that, we can calculate the breakeven analysis of it by putting the value in the formulas.

Example

Suppose we are starting a business of kids bicycles. And we are also the manufacturer of it. So let’s find out how many products we have to sell to get a breakeven point.

First, we have to find the fixed cost and variable costs. So our fixed cost, including all our employee’s salaries, rents, and others for one month is $50,000.

Our product’s selling price is $130, and the variable cost is $100. So the unit contribution margin is $130 – $100 = $30.

Now we have to find our Break-even analysis as units = fixed cost/unit contribution margin ($50,000/$30) is 1666 units.

So we have to sell 1666 units in a month to get a breakeven point.

And now we find the breakeven point in sales dollar = fixed cost/the ratio of unit contribution margin and selling price of the unit.

BEP = $50,000/($30/$13

It is approximately = $2,50,000

So we have to sell $2,50,000 to get the break-even point.

How to Control Break-even analysis

If you completed your breakeven analysis and if you found it; as a result, you have to sell more units of products, which may seem to be impossible.

Then we also can manage it by making small changes in our fixed costs and variable costs.

If we successfully reduce some fixed costs, then we may have to sell fewer units of products. We can reduce fixed costs by putting machines instead of some employees. We can negotiate with the house owner and reduce rent.

Like fixed costs, we can also change the variable costs by eliminating some unnecessary elements like we can replace our packaging materials with low-cost materials.

We also can increase our product’s price, because of which now we have to sell fewer products to touch the breakeven analysis.

But we have to consider one thing; we have to make all these changes very carefully, because if our product’s quality or price did not attract our target audience, then it will also be another failure to us.

Benefits of Break-Even Analysis

- Helpful for both small and large businesses.

- It is helpful when we are starting a new business. It helps us to decide whether we have to invest or not and may protect us from significant failures.

- When we are trying to add some new product in our product line, even that time also it helps us make the right decisions.

- It told us about the pricing strategy. Whether we have to increase our price or not.

- Because of this analysis, we can know exactly about our fixed costs, variable costs, and feature revenue.

- We can know about the extra expenses.

- It is also beneficial when we are searching for funding. Because when we do a breakeven analysis, then we have proof and by showing that we can convince our investors to invest in our business.

Limitations of Break-Even Analysis

- The limitation of the breakeven analysis is that sometimes we underestimate or miscalculate the costs then automatically the margin’s calculations also go wrong which leads to some significant loss.

- And one crucial thing to consider here is, it only tells you about, how many products or how much to sell but it never tells you about the product’s demand. So it means we do not have to trust in one method before starting a business. There are other tools or researches available to measure demand.

- There are other factors also available because of that a breakeven analysis’s prediction can be wrong. Like competitors, inflation, etc. If the competitor decreases its product’s price to compete with us, then we also have to decrease our price to survive.

Conclusion

If you want to start a business or you already have a business, and what to launch any product, then you must have to do the breakeven analysis.

Because when you do this, then it makes your decision clear whether to invest or not.

Suppose you have a service business like digital marketing, then how you can calculate the breakeven analysis?

To calculate it in a service business, first, calculate the fixed costs. Then variable costs and unit contribution margin. Then put that value in the formula then you can get your breakeven units.

Here we may consider the variable costs as the internet’s cost, computer’s cost, printing cost etc.

And we can consider the units as clients; one unit equals to one client. So in service providing business, we have to find how many clients we require to get the breakeven point.

Also you can read our blog on 3 Practical Steps To Conduct A Cost-Benefit Analysis

FAQ’s

Break-even analysis is a process; by using this process, businesses can find the breakeven points.

When a company generates the same revenue that they invested before, it means they are at no profit and no loss stage, then that point is called the breakeven point.

There are two types of formula available one is for finding how many units required and another is for the dollar value.

So the formula for unit calculation BEA = total fixed cost /unit contribution margin

And the formula for the dollar value, BEA = total fixed cost /ratio of unit contribution margin & unit selling price.

To conduct a breakeven analysis, we have to make a list of all the fixed costs, variable costs and unit contribution margin.

After that, simply we just have to put that value in the formula, which is BEA= total fixed costs /unit contribution margin.

The production volume has played an important role to control the breakeven analysis.

Suppose in one day your company produces 100 in one day, and that costs you $1000. If you increase your efficiency and produce 120 products in one day, then your profit increases but your costs remain the same.

And if we reduce the costs by then, we have to sell fewer units of product to get the breakeven point.

When you start a new business, then obviously some questions arise in your mind, like how much I have to invest? How much profit will I get? Etc etc.

So breakeven analysis helps us to solve these types of problems, by calculating your all costs and expenses through a formula.